Productive Financing for Micro, Small and Medium Enterprises (MSMES): Efforts to Achieve the Sustainable Development Goals (SDGS)

Abstract

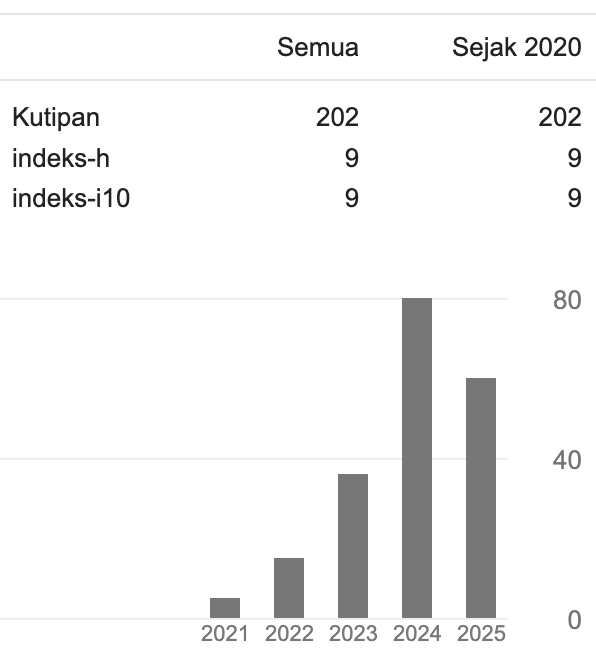

This study aims to describe the productive financing of Bank Syariah Indonesia for MSMEs as an effort to achieve the SDGs using a literature review approach on secondary data in the form of financial statements and supporting data. The data was processed through financial statement analysis techniques, SATF Value performance measurement, and studies on relevant articles and literature. The results on Amanah's performance with the responsibility indicator, show that financing growth in MSME customers fluctuates, especially in 2021-2023 due to the Covid-19 pandemic. However, BSI continues to strive to follow its commitment to provide opportunities and convenience in financing, especially in the MSME sector. BSI has disbursed financing to MSMEs amounting to IDR 47.72 trillion or grew 14.54% annually. BSI also expands access to sharia financing, including through BSI Agen which resulted in 4.8 million transactions with a transaction volume of Rp 11 trillion, the MSME Center to increase the capacity and capability of MSMEs which has distributed financing of Rp 39.08 billion to more than 3,281 MSMEs fostered by BSI. BSI also has a platform namely the Digital Salam Portal to make it easier for the public to apply for microfinance digitally, to meet all business and investment needs, and provides financing for entrepreneurs at various levels of business, ranging from the micro level to corporations. BSI realizes that productive financing in the MSME sector has a huge role in realizing the SDGs, especially in the Decent Work and Economic Growth Target.

References

Arrahman, Hafizh, and Diah Arminingsih. 2024. “Peran Produk Pembiayaan Bank Kalbar Syariah Pada Perkembangan UMKM Di Kota Pontianak.” Prosiding Program Studi Ekonomi Islam 2: 2024.

Asari, Hasan. 2023. “Peran Perbankan Syariah Dalam Mengembangkan UMKM (Usaha Mikro Kecil Menegah) Di Kabupaten Lombok Timur Ditinjau Berdasarkan Pasal 3 Uu No. 21 Tahun 2008 Tentang Perbankan Syariah.” JURIDICA : Jurnal Fakultas Hukum Universitas Gunung Rinjani 5 (1): 24–29. https://doi.org/10.46601/juridicaugr.v5i1.233.

Bank Syariah Indonesia. 2024a. “BSI Tegaskan Komitmen Terus Dorong Pembiayaan UMKM.” June 2024.

———. 2024b. “BSI UMKM Center, Inisiatif Strategis Dukung Wirausaha Jadi Berdaya & Naik Kelas.” August 2024.

Dewi, Sandra, Yaswirman, Helmi, and Henmaidi. 2023. “Peran Perbankan Syariah Dalam Meningkatkan Pembangunan Berkelanjutan Di Indonesia.” Jurnal Pajak & Bisnis 4 (2): 229–41.

Fadilah, Khafidhotul. 2024. “Peran Bank Syariah Indonesia Untuk Mendukung SDGS Dalam Pengentasan Kemiskinan Dan Pengangguran Melalui Pembiayaan Produktif.” Cirebon: IAIN Syekh Nur Jati.

Hani, Syafrida, Muhammad Yasir Nasution, and Saparuddin Siregar. 2020. “Performance Assessment of Islamic Banks in the Leadership Value of the Prophet Muhammad: A Conceptual Framework.” Journal of Islamic, Social, Economics and Development (JISED), no. 29 (June): 10–18.

Harmar, Pramesti, Muhammad Iqbal Fasa, and Suharto. 2021. “Peran Perbankan Syariah Dalam UMKM Untuk Mengembangkan Ekonomi Indonesia.” Profit: Jurnal Kajian Ekonomi Dan Perbankan, no. 1: 68–77.

Herlinawati, Erna, and Evy Ratno Arumanix. 2017. “Analisis Pendapatan Umkm Sebelum Dan Sesudah Menerima Kredit Tunas Usaha Rakyat.” Jurnal Indonesia Membangun 16 (2): 1–13.

IIs, Ayu Aryanti. 2023a. “Iis Ayu Aryanti.” Lampung: UIN Raden Intan Lampung.

———. 2023b. “Pengaruh Sustainable Development Goals (SGDs) Terhadap Perkembangan Umkm Melalui Produk Pembiayaan Produktif Sebagai Variabel Intervening Dikaji Dalam Perspektif Islam (Studi Pada BSI KCP Kedaton Bandar Lampung).” UIN RADEN INTAN LAMPUNG.

Indonesia Chamber of Commerce and Industry. 2023. “UMKM Indonesia.” 2023.

Kementerian Keuangan Republik Indonesia. 2023. “Usaha Mikro, Kecil Dan Menengah (UMKM).” June 2023.

Komite Nasional Ekonomi dan Keuangan Syariah. 2020. “Keuangan Syariah Seharusnya Jadi Motor Penggerak Utama SDGs.” KNEKS. August 2020.

Mayasari, Selvi. 2024. “Perbankan Syariah Terus Memacu Pembiayaan Ke Sektor UMKM.” Kontan, May 2024.

Media Digital. 2020. “BRI Pacu UMKM Untuk Berkembang Dan Wujudkan SDGs Di Indonesia.” Media Digital, November 2020.

Purwanti, Teti. 2024. “Sederet Langkah BSI Dalam Mendongkrak Peran UMKM.” CNBC Indonesia, October 2024.

Setiawan, Iwan. 2019. “Peran Perbankan Syariah Terhadap Pengangguran Dalam Sistem Perbankan Dan Moneter Ganda Di Indonesia.” Jurnal Ekonomi Dan Bisnis 21 (1): 46.

Simamora, Nurtiandriyani. 2024. “Penyaluran Pembiayaan Bank Syariah Ke Sektor UMKM Meningkat Pada Kuartal II-2024.” Kontan, July 2024.

Suretno, Sujian, and Bustam. 2020. “Peran Bank Syariah Dalam Meningkatkan Perekonomian Nasional Melalui Pembiayaan Modal Kerja Pada UMKM.” Ad-Deenar: Jurnal Ekonomi Dan Bisnis Islam, no. 4. https://doi.org/10.30868/ad.v3i01.752.

Trimulato, M. C. Nafis, and E Amalia. 2022. “The Role Sharia Fintech Support Sustanaible Development Goals Program (SDGs).” Jurnal Ilmiah Ekonomi Islam 8 (1): 251–59.

Trimulato, Nur Syamsu, and Mega Octaviany. 2021. “Sustainable Development Goals (SDGs) Melalui Pembiayaan Produktif UMKM Di Bank Syariah.” Islamic Review Jurnal Riset Dan Kajian Keislaman, no. 10 (April): 19–38. https://doi.org/10.35878/islamicreview.v10.i1.269

Copyright (c) 2024 Kunuz: Journal of Islamic Banking and Finance

This work is licensed under a Creative Commons Attribution 4.0 International License.