Analysis Produk Keuangan Syariah Sukuk

Abstract

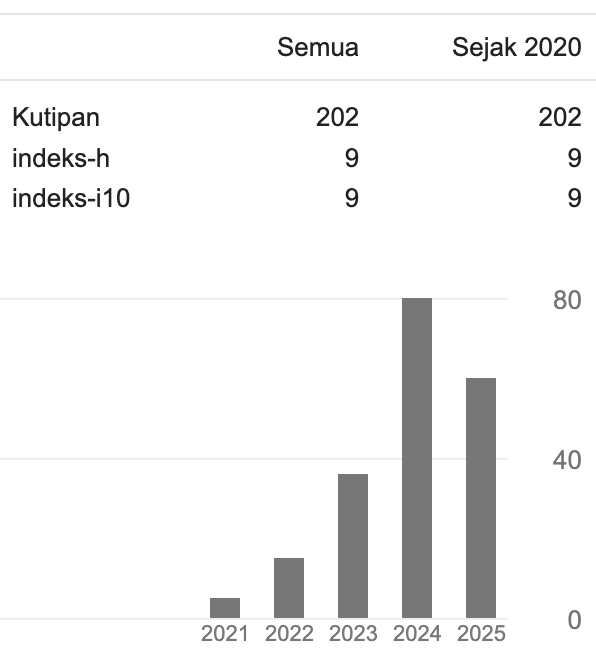

The development of the financial industry continues increase people are increasingly interested in using Islamic financial products. The products offered are increasingly varied to meet the needs of the community. In addition to providing benefits, Islamic financial products can contribute widely to the development of the country, in this case, the Sukuk product. Legally, Sukuk or Islamic bonds, get the law first, when compared to Islamic banks. Sukuk has law number 19 of 2008 concerning State Sharia Securities (SBSN). The Sukuk instrument continues to grow and can provide benefits for investors and benefits for the country's development. The purpose of this study is to determine the development of state Sukuk products, and analysis of Islamic financial products. The method used is qualitative, with a literature study approach. The data sources used are secondary data, data that has been presented by certain institutions and then processed, and from other sources deemed relevant to the theme. The data collection technique used is literature study from several sources, both from books, journals, and others. The analytical technique used is descriptive qualitative, describes the development of Sukuk products in 2020 to 2021, and describes the analysis of the Sukuk ijarah products. The results of this study indicate that there are developments in state Sukuk in the 2019 to 2020 period, PBS Auction Sukuk, PBS Private Placement Sukuk, SNI, SPN-S, Rite Sukuk (SR), and Savings Sukuk (ST) grew by 40.80 percent. Auction PBS Sukuk grew by 39.59, PBS Private Placement Sukuk grew by 214.39%, SR grew by 72.93%, SNI Sukuk by 26.86 percent. Meanwhile, SNI Sukuk decreased by -30.01% and ST decreased by -35.76 percent. Analysis of Islamic sharia financial products, especially with the ijarah scheme. There is a sale and purchase transaction is considered engineered, then the resale of assets from the investor to the issuer such as a sale and purchase transaction is prohibited. Buying and selling of Sukuk assets which are then leased back and have a time limit and conditions on the object of sale and purchase, making the seller not have control over the asset. Then the sale and purchase can become a sale and purchase without the obligation to resell the product that has been purchased if the owner of the goods can return the money for the goods he sells.

References

Adnan, A. A., & Bukido, R. (2020). Poverty and Religiosity: The ‘Missing Link’ From Islamic Perspective. Jurnal Ilmiah Al-Syir’ah, 18(2), 175–188.

Hasan, F. (2019). Menyoal Sisa Uang Belanja yang Tidak Dikebalikan Penjual Ditinjau dari Sisi Hukum dan Hukum Islam. In Menjadi Islam di Tengah Tantangan Modernitas (pp. 65–82). Istana Agency.

Hasan, F., & Habu, M. J. S. (2019). Implementation of the National Islamic Council Fatwa Number 47/DSN-MUI/II/2005 in Banks Syariah Mandiri Branch Manado. Jurnal Ilmiah Al-Syir’ah, 17(1). https://doi.org/10.30984/jis.v17i1.870

Jan, R. H., Lydia, E. L., Shankar, K., Hashim, W., & Maseleno, A. (2019). The increasing market of ecommerce and its impact on retailer. Journal of Critical Reviews, 6(5), 122–127.

Latief, N. F. (2019). Accounting for Zakat and Infaq (Sadaqah) at Badan Amil Zakat Nasional (BAZNAS) in North Sulawesi, Indonesia. International Journal of Accounting & Finance in Asia Pasific (IJAFAP), 2(2).

Latief, N. F. (2019). MANAGING ZAKAT IN THE 4.0 ERA: AN IMPLEMENTATION OF SiMBA IN BAZNAS OF NORTH SULAWESI. Share: Jurnal Ekonomi Dan Keuangan Islam, 8(2), 238. https://doi.org/10.22373/share.v8i2.5550

Latief, N. F., Chauhan, R., Thakar, I., Maseleno, A., & Wahyudi, A. (2020). Impact, Cause and Trend: India’s Trade of Crude and Petroleum Products. International Journal of Advanced Science and Technology, 29(06), 1823–1831.

Latief, N. F., & Niu, F. A. L. (2020). Accounting Information and Psychological Factors in Capital Market : Do these Affect the Investors’ Decisions to Invest? Jurnal Reviu Akuntansi Dan Keuangan, 10(2), 335–348. https://doi.org/10.22219/jrak.v10i2.12931

Latief, N. F., & Niu, F. A. L. (2020). Utilization of Productive Zakat in Improving Mustahik Economic Empowerment (Study at BAZNAS of Manado City). International Journal of Accounting & Finance in Asia Pasific, 3(2), 13–25. https://doi.org/10.32535/ijafap.v3i2.761

Latief, N. F., & Sandimula, N. S. (2022). How Accountable is Zakat Management in Indonesia? An Evidence from BAZNAS of North Sulawesi. Share: Jurnal Ekonomi Dan Keuangan Islam, 11(1), 42–60.

Latief, N. F., & Sandimula, N. S. (2022). How Accountable is Zakat Management in Indonesia? An Evidence from BAZNAS of North Sulawesi. Share: Jurnal Ekonomi Dan Keuangan Islam, 11(1), 42. https://doi.org/10.22373/share.v11i1.11194

Niu, F. A. L. (2022). Use of Digital Transaction Services During the Pandemic Based on Perceptions of Community in Manado, Indonesia. Khazanah Sosial, 4(3), 501–512. https://doi.org/10.15575/ks.v4i3.17711

Persulessy, G., Latief, N. F., Ariyanto, D., Mayndarto, E. C., & Yuliusman, Y. (2020). Report on Role of Innovative Strategies in Accounting Evaluation. TEST Engineering & Management, 82, 14120–16301.

Jan, R. H., & Hasan, F. (2020). Pengaruh Kompetensi Terhadap Komitmen Organisasi Pada Perguruan Tinggi Keagamaan Islam Negeri Di Indonesia Timur. Gorontalo Management Research, 3(1), 176–190.

Yusuf, N., Hasan, F., & Niu, F. A. L. (2019). PEMIKIRAN MUHAMMAD HATTA TENTANG EKONOMI SYARIAH DI INDONESIA. Potret Pemikiran, 23(1), 36. https://doi.org/10.30984/pp.v23i1.973

Bachruddin, B. (2008). Keberadaan Obligasi Syari’ah di Indonesia: Peluang dan Tantangannya. Unisia. https://doi.org/10.20885/unisia.vol31.iss70.art1

Darsono.et al. (2017). Masa depan keuangan syariah indonesia. Tazkia Publishing & Bank Indonesia.

Djayusman, R. R. (2015). ISLAMIC BONDS: Tinjauan Fikih dan Keuangan. In ADDIN. https://doi.org/10.21043/addin.v8i1.594

DJPPR Kementerian Keuangan RI. (2019). Laporan Tahunan 2020.

DSN-MUI. (2020). FATWA DEWAN SYARIAH NASIONAL-MAJELIS ULAMA INDONESIA NO: 137/DSN-MUIAX2020 Tentang SUKUK.

DSN-MUI. (2002). Fatwa Dewan Syari’ah Nasional Nomor: 32/DSN-MUI/IX/2002. Dewan Syariah Nasional MUI.

http://erwanditarmizi.com/wp-content/uploads/2016/06/Cetakan-5-sukuk-ijarah.pdf

Fauziah, S., Fauziah, N. E., & Febriadi, S. R. (2018). Analisis Fiqh Muamalah tentang Jual Beli Sukuk Terhadap Pelaksanaan Program Buyback Dalam Produk Sukuk Ritel di Brisyariah Fiqh Mumalah Analysis About Selling And Buying of Sukuk to Implementation Buyback Program on Retail Sukuk Product In Brisyariah KCP. Prosiding Hukum Ekonomi Syariah (Februari, 2018) UNISBA, 251–256.

Haikal, T. (2011). Panduan Cerdas & Syar’i Investasi Syariah. Araska.

Hakim, M. L. (2018). Obligasi Konvensional Dan Obligasi Syariah (Sukuk) Dalam Tinjauan Fiqih. Prodi Ekonomi Syari‟ah.

Hilal, S. (2014). Urgensi Ijarah Dalam Prilaku Ekonomi Masyarakat. Jurnal Asas.

https://www.bwi.go.id/cash-waqf-linked-sukuk/

https://zibinuma.blogspot.com/2017/05/ijarah.html?m=1

Hulwati, H. (2017). Investasi Sukuk: Perspektif Ekonomi Syariah. JEBI (Jurnal Ekonomi Dan Bisnis Islam), 2(1), 85–96. http://journal.febi.uinib.ac.id/index.php/jebi/article/view/70

Iska, S. (2012). Sistem Perbankan Syariah di Indonesia dalam Perspektif Fikih Ekonomi. Fajar Media Press.

Jamaluddin. (2019). Elastisitas Akad Al-Ijarah (Sewa-Menyewa) dalam Fiqh Muamalah Persfektif Ekonomi Islam. Ejournal Iai -Tribakti.

Laiala, Nisful. (2019). Pengembangan Sukuk Negara di Indonesia Analisis Komprehensif dalam Menggali Alternatif Solusi dan Strategi Pengembangan Sukuk Negara Indonesia.

Muhayatsyah, A. (2020). Aspek Syariah Pada Instrumen Sukuk: Analisis Penerapan Sukuk Wakaf di Indonesia. J-ISCAN: Journal of Islamic Accounting Research. https://doi.org/10.52490/j-iscan.v2i2.891

Mulyani, R., & Setiawan, I. (2020). SUKUK RITEL NEGARA, INSTRUMEN INVESTASI HALAL UNTUK MEMBANGUN NEGERI. IQTISADIYA: Jurnal Ilmu Ekonomi Islam.

Nopijantoro, W. (2017). Surat Berharga Syariah Negara Project Based Sukuk (SBSN PBS): Sebuah Instrumen Alternatif Partisipasi Publik Dalam Pembiayaan Infrastruktur. Substansi.

Nurkamilah, A., Suprihatin, T., & Bayuni, E. M. (2020). Analisis Fatwa DSN terhadap Pelaksanaan Akad Ijarah pada Pembiayaan BMT Itqan Bandung Analysis of Implementation DSN Akad Ijarah Financing BMT Itqan in Bandung. In Ekonomi Islam.

Syams, A., & Fahmi, R. (2018). Penerapan Kaidah Fiqhiyah pada Transaksi Jual Beli Sukuk. Al-Mu’amalat: Journal of Islamic Economic Law, 1(1).

Trimulato, T., & Ismawati, I. (2021). The Optimization of Sharia Financial Institution as Agent of Sale For Sukuk Product. Islamic Economics, Finance, and Banking Review, 1(1).

Umam & Utomo, K. & S. B. (2016). Perabankan Syariah Dasar-dasar dan Dinamika Perkembangannya di Indonesia. RajaGrafindo Persada.

UU.No.19. (2008). Surat Berharga Syariah Negara.

Wahab. (2012). Obligasi Syari’ah (Sukuk) Dalam Perspektif Ushul Fiqh.

Zubair, M. K. (2012). Obligasi dan Sukuk dalam Perspektif Keuangan Islam (Suatu Kajian Perbandingan). Asy-Syirah: Jurnal Ilmu Syariah Dan Hukum.